Vancouver, British Columbia, March 20th, 2024: Gold Hunter Resources Inc. (CSE: HUNT) (the “Company” or “Gold Hunter”) is pleased to announce the results of its annual general and special meeting of shareholders of the Company (the “Shareholders”) held on March 15, 2024 (the “Meeting”). A total of 25,673,122 common shares of the Company (the “Common Shares”) were voted, representing 65.842% of the Company’s issued and outstanding Common Shares.

At the Meeting, the Shareholders approved, by special resolution, the previously announced share purchase and sale transaction with FireFly Metals Ltd. (“FireFly”), whereby FireFly will acquire all of the common shares of 1451366 B.C. Ltd. (the “Subsidiary”), a wholly-owned subsidiary of Gold Hunter, in exchange for the issuance to Gold Hunter of 30,290,624 ordinary shares in FireFly (the “FireFly Shares”), valued at CDN$15 million (the “Transaction”). The Shareholders cast a total of 25,673,122 votes, of which 20,456,122 Common Shares, or 98.143%, were voted in favour of the special resolution approving the Transaction. Completion of the Transaction remains subject to the completion of certain customary closing conditions.

In addition, the Shareholders approved, by special resolution, the previously announced statutory plan of arrangement (the “Arrangement”) under section 288 of the Business Corporations Act (British Columbia), pursuant to which the Company plans to distribute a portion of the FireFly Shares to the Shareholders on a pro-rata basis proportionate to their current shareholding in Gold Hunter, or for certain Shareholders resident in the U.S. who do not qualify as accredited investors as defined in Rule 501(a) of Regulation D, as promulgated by the United States Securities and Exchange Commission under the U.S. Securities Act of 1933, as amended, a cash payment in lieu of the FireFly Shares (collectively, the “Distribution”) . Out of the 25,673,122 votes cast by the Shareholders at the Meeting, 20,456,122 Common Shares, or 98.143%, were voted in favour of the special resolution approving the Arrangement.

Completion of the Arrangement remains subject to receipt of the court order (the “Court Order”) of the Supreme Court of British Columbia (the “BCSC”) and certain other customary closing conditions. Gold Hunter will work towards submitting an application to the BCSC for the Court Order in the coming weeks, after which, the Company will provide further updates to the Shareholders regarding the particulars of the Distribution.

For more information regarding the Transaction or the Arrangement, see the Companies’ news releases filed on December 21, 2023 and January 18, 2024.

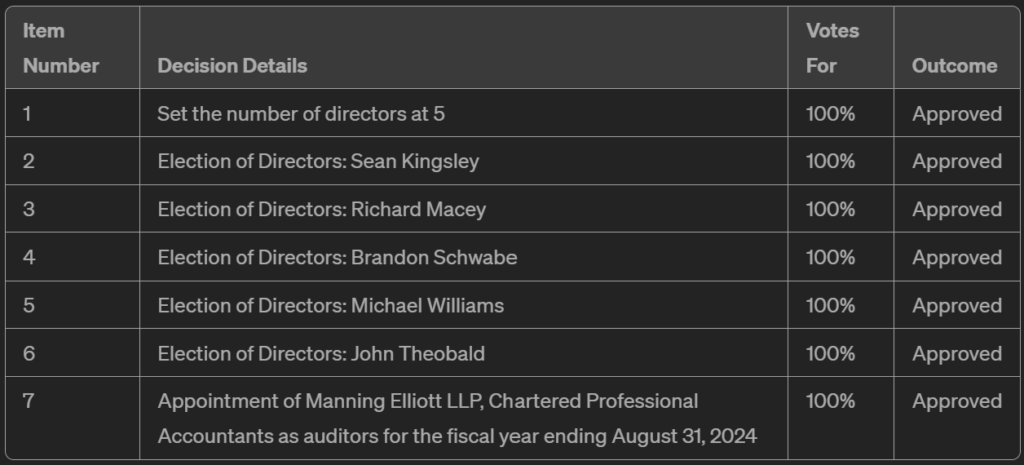

The Shareholders also approved the following matters at the Meeting:

Update to the Marwan I Option Agreement

As previously announced on December 21, 2023, the Company entered into an amendment agreement to the mineral property option agreement, dated January 17, 2022 (the “Option Agreement”) involving Gold Hunter and Unity Resources Inc., along with individuals Gary Lewis, Jerry Jones, Nicholas Rodway, Aubrey Budgell, and Paul Delaney, whereby Gold Hunter was granted an option (the “Option”) to acquire a 100% interest in the Marwan I claim group located in Newfoundland & Labrador.

On March 18th, 2024, in connection with the Option Agreement, the Company entered into a second amendment agreement (the “Second Amendment”) to the finder’s fee agreement dated January 17, 2022, as amended and restated on January 16, 2024 (the “First Amendment”, and together with the Second Amendment, the “Amended and Restated Finder’s Fee Agreement”), among Canal Front Investments Inc. (“Canal”), Sean Kingsley (“Kingsley”), Mango Research & Management Inc. (“Mango”), a company wholly-owned by Sean Kingsley, and FireFly. Pursuant to the First Amendment, the Company had agreed to pay Canal and Kingsley (the “Finders”) a finder’s fee (the “Finder’s Fee”) of $40,000 in cash and 480,000 Common Shares, split equally between the Finders, upon the full exercise of the Option. Under the Second Amendment, Kingsley is now replaced by Mango as a Finder, FireFly is now a party and covenanter, and FireFly has agreed to pay the $40,000 cash payment of the Finder’s Fee upon the full exercise of the Option.

The Amended and Restated Finder’s Fee Agreement constitutes a related party transaction under Multilateral Instrument 61-101 (“MI 61-101”) as Kingsley, the President and Chief Executive Officer of Gold Hunter, is also the sole director, officer, and shareholder of Mango. The Company has relied on exemptions contained in MI 61-101 for an exemption from the formal valuation requirement and minority shareholder approval requirement.

FireFly Metals Company Profile

FireFly, is an emerging leader in the copper-gold sector, focused on advancing the high-grade Green Bay Copper-Gold project in Newfoundland & Labrador, Canada, which they acquired earlier this year for AUS$65 million. Immediately after acquiring this project, they launched a 40,000-metre drill program, demonstrating an aggressive commitment to expanding the deposit. This approach aligns very well with Gold Hunter’s surrounding mineral claims that are being acquired as it gives FireFly a true district-scale opportunity to build an exciting VMS camp. Additionally, FireFly Metals holds a 70% interest in the high-grade Pickle Crow Project in the world-class Uchi sub-province of Ontario, Canada.

About Gold Hunter Resources Inc.

Gold Hunter Resources is a mineral exploration company committed to the evaluation and development of mineral-rich regions in Newfoundland and Labrador, as well as Ontario, Canada. Our operations are concentrated in areas known for their abundant mineral resources. We’re dedicated to unveiling the full potential of our project sites in a manner that prioritizes responsibility and sustainability.

On Behalf of the Board of Directors,

GOLD HUNTER RESOURCES INC.

“Sean A. Kingsley“

President, CEO, and Director

Contact Information

Email: info@goldhunterresources.com

Phone: +1 604-440-8474

www.goldhunterresources.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: “believes”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled” or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved.

All statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, that the Company and Firefly will complete the Transaction, the Company will obtain the Court Order approving the Arrangement, the Company will complete the Distribution, and the full exercise of the Option.

Although the Company believes that such statements are reasonable and reflect expectations of future developments and other factors which management believes to be reasonable and relevant, the Company can give no assurance that such expectations will prove to be correct. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that it and FireFly will obtain the required approvals for the Transaction, the Company will obtain the required approvals for the Distribution, and that market fundamentals will support the viability of critical mineral resource exploration.

Other factors may also adversely affect the future results or performance of the Company, including general economic, market or business conditions, future prices of minerals, changes in the financial markets and in the demand for minerals, changes in laws, regulations and policies affecting the mineral exploration industry, as well as the risks and uncertainties which are more fully described in the Company’s annual and quarterly management’s discussion and analysis and in other filings made by the Company with Canadian securities regulatory authorities under the Company’s SEDAR+ profile.

Ongoing labour shortages, inflationary pressures, rising interest rates, the global financial climate and ongoing international conflicts are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company’s operating performance, financial position, and future prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable.

No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The Company does not undertake any obligation to update such forward‐looking information whether because of new information, future events or otherwise, except as expressly required by applicable law.